7 Easy Facts About The Small Business Owner's Guide to the CARES Act Shown

Excitement About SBA EIDL Loan vsSBA Paycheck Protection Program

Just submit your business details including payroll filings and certifications necessary for eligibility and the required files needed for the PPP loan. We will quickly and firmly review your application and determine just how much you can access. If you're authorized, safely link your savings account, and we'll transfer your funds when you're prepared.

SBA to Increase EIDL Loan Amounts to $2 Million After Labor Day - Inc.com

Does Your Business Qualify for A $10,000 EIDL Grant in 2021? - SBG Funding

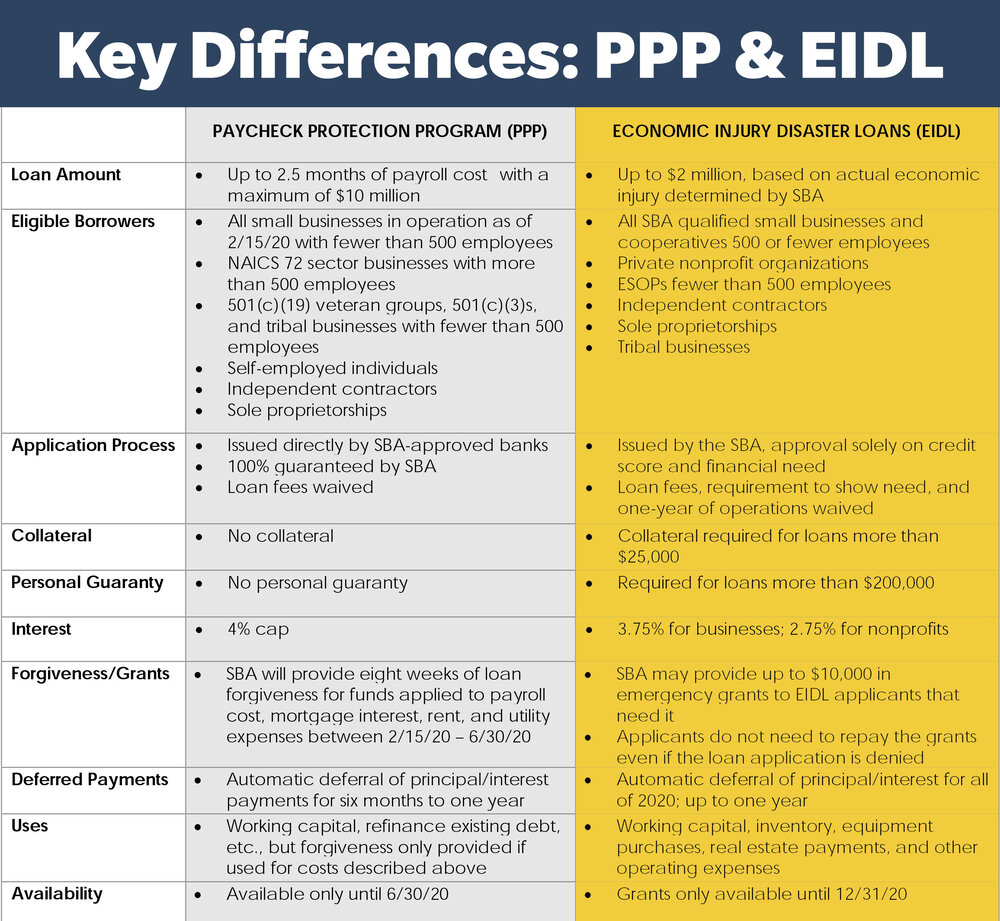

Many small-business owners understand that the Coronavirus Help, Relief, and Economic Security (CARES) Act, through the Small Company Administration (SBA), provided monetary relief through two targeted loan packagesthe Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL) program. Passage of the Consolidated Appropriations Act (CAA), 2021 on Dec.

Rumored Buzz on Update on EIDL (Economic Injury Disaster Loans)

31, 2021, and produced a brand-new Targeted EIDL Advance program. The COVID-19 EIDL program, initially arranged to end Dec. 31, 2020, has actually been extended through Dec. 31, 2021, with the passage of the Consolidated Appropriations Act (CAA), 2021. The original EIDL Advance ended July 11, 2020, and is no longer available.

The American Rescue Strategy of 2021 provides $15 billion in additional financing for the special Targeted EIDL Advance grants. It directs that Targeted EIDL Advance funds will not be included in gross income. Here's what you need to know to look for an EIDL and details about the brand-new Targeted EIDL Advance, in case you certify: Key Takeaways Although the original EIDL Advance program has expired, EIDLs will continue to be available through Dec.

What are the differences between the EIDL and PPP loan programs? - Mason Enterprise Center Leesburg

The Main Principles Of SBA enhances disaster loan program citing Delta variant

You can not look for the brand-new EIDL Targeted Advance, which is just available to select applicants in low-income neighborhoods. If you get approved for a brand-new EIDL Targeted Advance, the SBA will notify you. You need to certify for a COVID-19 EIDL as a small company by variety of workers. The optimum loan amount, based upon economic injury suffered, is $500,000 since April 6, 2021.

Qualification To receive an EIDL, your organization needs to fulfill the SBA definition and size standards of a little service, be found in the United States or a U.S. territory, and have actually suffered working capital losses due to the coronavirus pandemic. Meaning https://pastebin.fun/ge83wgggah According to the SBA, a small company: Is organized for profit, Has a place of service in the U.SOperates mainly within the U.S.